Player Feature - Monthly Deposit Potential

This page outlines how our Monthly Deposit Potential model works, what benefits it brings to your strategy, and how it improves your understanding of Player Value beyond traditional deposit metrics.

Player Value is typically measured by how much a player deposits — using last month's average deposit, net deposit, lifetime value (if a player has been inactive for a while), or a combination of these.

However, these approaches fall short when players go through winning streaks, temporary inactivity, or inconsistent deposit patterns.

At Fast Track, we define ‘Player Value’ as the player's Monthly Deposit Potential. This changes the game by focusing on what a player is capable of depositing monthly from their own pocket, instead of just what they’ve done recently.

This insight gives you more accurate segmentation, smarter targeting, and fairer treatment of high-potential players who may appear inactive.

💭 How Do We Build Monthly Deposit Potential?

The model is built on net deposits (Deposits – Withdrawals), focusing on recent active periods, combined with intelligent decay logic and temporary boosts.

Here’s how we do it:

🔧 Calculation Steps

- Daily Net Deposit = Each day calculate the player's net deposit as Deposits - Withdrawals.

- Cumulative Net Deposit = The total amount of own money the player has invested, excluding winnings.

- Temporary Boost from big wins = After a big win and withdrawal, we temporarily increase the player's potential as they might re-deposit.

- If that money is not re-deposited within a certain period, we assume it's spent elsewhere and we "forget" the win.

🧠 Core Concept

- Real Net Deposits = The main data source is the factual player deposits.

- Immediate Value Increase = Increase of deposits leads to immediate increase of value.

- Delayed Value Decrease = Decrease of deposits leads to a delayed decrease of value.

- Memory Decay Big Wins = We slowly forget big wins if a player doesn’t re-deposit the winnings.

- Financial Behaviour Analysis = Concepts from stock market analysis for player value time series. Payment activity is analysed like price movement. We apply indicators to smooth out noise and outliers.

⚙️ How Does the Model Work?

Let’s break it down using an example:

- Imagine a player who usually deposits around €500 per month.

- One month, they win big — say €5,000 — and stop depositing.

- Traditional models would immediately drop their value, but Monthly Deposit Potential sees this as a temporary fluctuation and smooths the impact using exponential decay.

- If the player withdraws winnings, their Monthly Deposit Potential is temporarily boosted, expecting a potential re-deposit.

- If the player doesn’t return, the model slowly adjusts their value downward instead of falling sharply.

This approach smooths out spikes, keeps value aligned with recent behaviour, and avoids abrupt negative changes in segmentation. In other words, it gives players the chance to re-deposit and prove their true value — helping operators target them more accurately and avoid underestimating valuable players too soon.

🏁 What's Next

📊 Segmentation: Player Value Segments

Players are automatically segmented based on their Monthly Deposit Potential score:

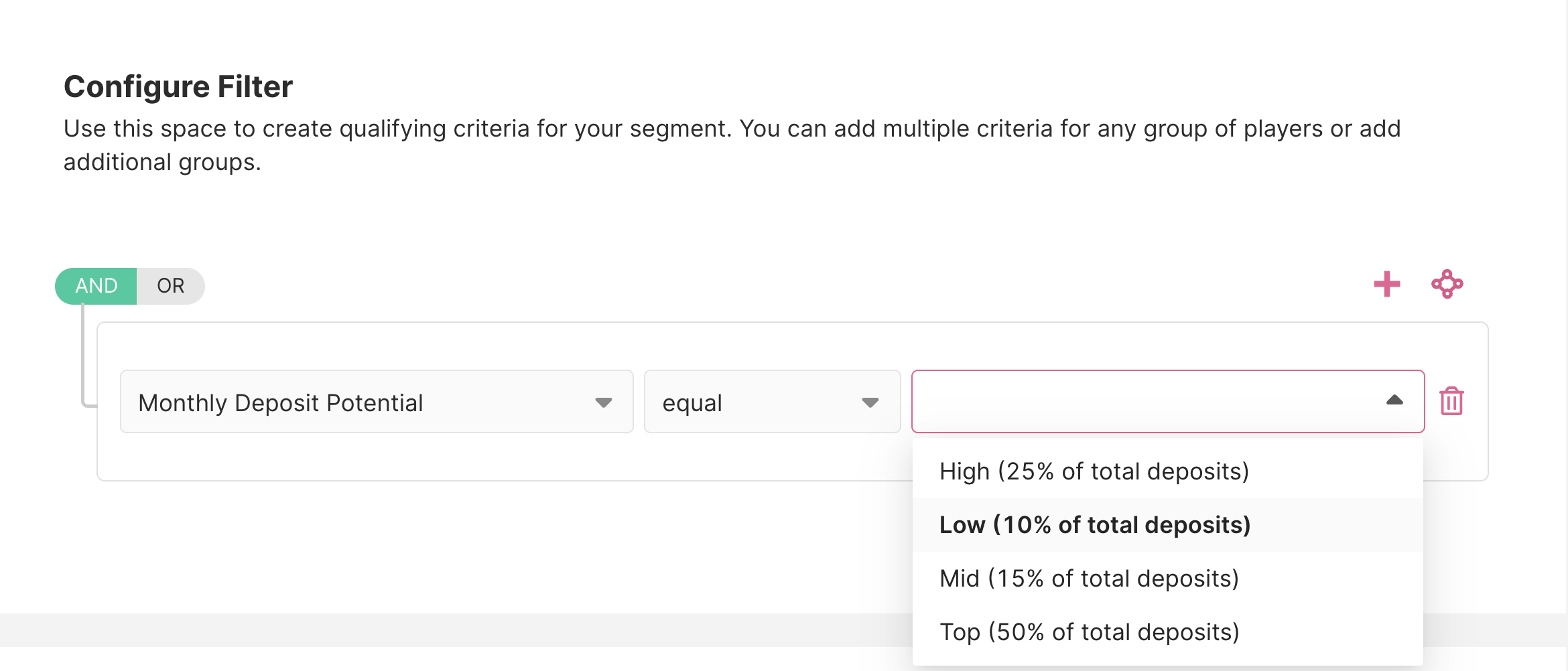

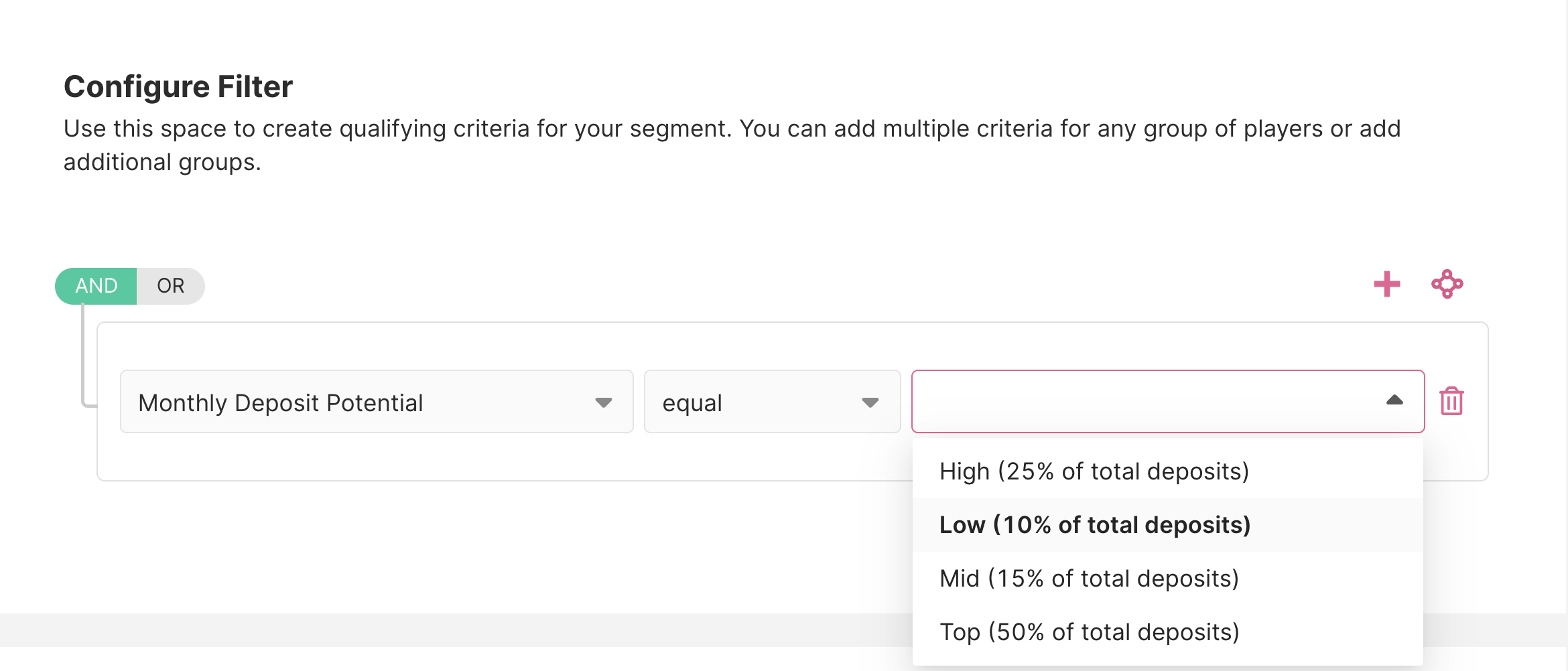

- 💎 Top — Highest deposit potential players (50% of total Monthly Deposit Potential).

- 🥇 High — High deposit potential players (25% of total Monthly Deposit Potential).

- 🥈 Mid — Moderate deposit potential players (15% of total Monthly Deposit Potential).

- 🥉 Low — Lower deposit potential players (10% of total Monthly Deposit Potential).

Following this, you can use the Player Feature Monthly Deposit Potential when creating segments for Activities and Lifecycles. You will be able to find Monthly Deposit Potential amongst the segment fields when you’re creating a segment.

📈 Dashboard

After some time, once the computation triggers have fired, you’ll be able to access different dashboards:

1- Inside Data Studio > System Dashboard, you will find the main dashboard for Monthly Deposit Potential. This is a read-only dashboard displaying three key metrics:

- Average Deposit Potential

- Average Daily Deposits

- Negative Average Daily Withdrawals

We recommend using this dashboard as a starting point. You can copy it to your Private or Brand tab to personalise it. Here’s a simple way to get started 👇

- From the System Dashboards section, click the three dots near your dashboard and select "Copy Dashboard to group".

- Choose whether to copy it to the Private Dashboard or Brand Dashboards tab.

- Open the copied dashboard and click “Edit Mode” in the top-right corner.

- Click “Edit Widget” to start customising your dashboard.

👉 Some actions you can include:

- Add a filter to search by a specific User ID.

- Break the data down into smaller segments by adding the User ID dimension.

- Filter the data by time using the Time filters.

2- Within the Player Feature, you’ll find two dashboards providing key insights about your players:

- Current Player Distribution Dashboard: See how players have been assigned to one of the classes in the Player Feature.

- Last 500 Movements This Week: Track the 500 most recent player movements from one category to another.

🏆 Benefits You Will See

🎯 Smarter Segmentation

Instead of relying solely on recent behaviour, you can group players based on their actual Monthly Deposit Potential. These value-based segments help you set the right bonus size or incentive level for each player. For example, you could split your players into groups such as:

- Low→ Lower-value players who should receive smaller, sustainable offers.

- Mid → Players who can be engaged with mid-range incentives.

- High → Eligible for high-value bonuses and potentially VIP-level perks.

- Top → High-deposit players who justify custom incentives, top-tier bonuses, and premium service.

While Monthly Deposit Potential helps define how much to offer, how and when you target these players should be based on additional behavioural and lifecycle data.

🔄 Predictive Retention

Prevent losing players due to misjudged value. For instance, a temporarily inactive VIP won’t be targeted in a low-tier reactivation campaign just because they paused for a few weeks. Instead, the model avoids abrupt downgrades and considers broader scenarios — such as when a player goes on a winning streak, withdraws it, and is temporarily spending those funds elsewhere.

📈 Real-Time Personalisation

The Monthly Deposit Potential model can be integrated across multiple touch-points, for example:

- Email/SMS campaigns → Tailor your communication based on each player’s potential.

- Bonus logic → Align bonuses with true player value. Avoid offers that are too high to unlock or too low to engage, and deliver rewards that truly motivate.